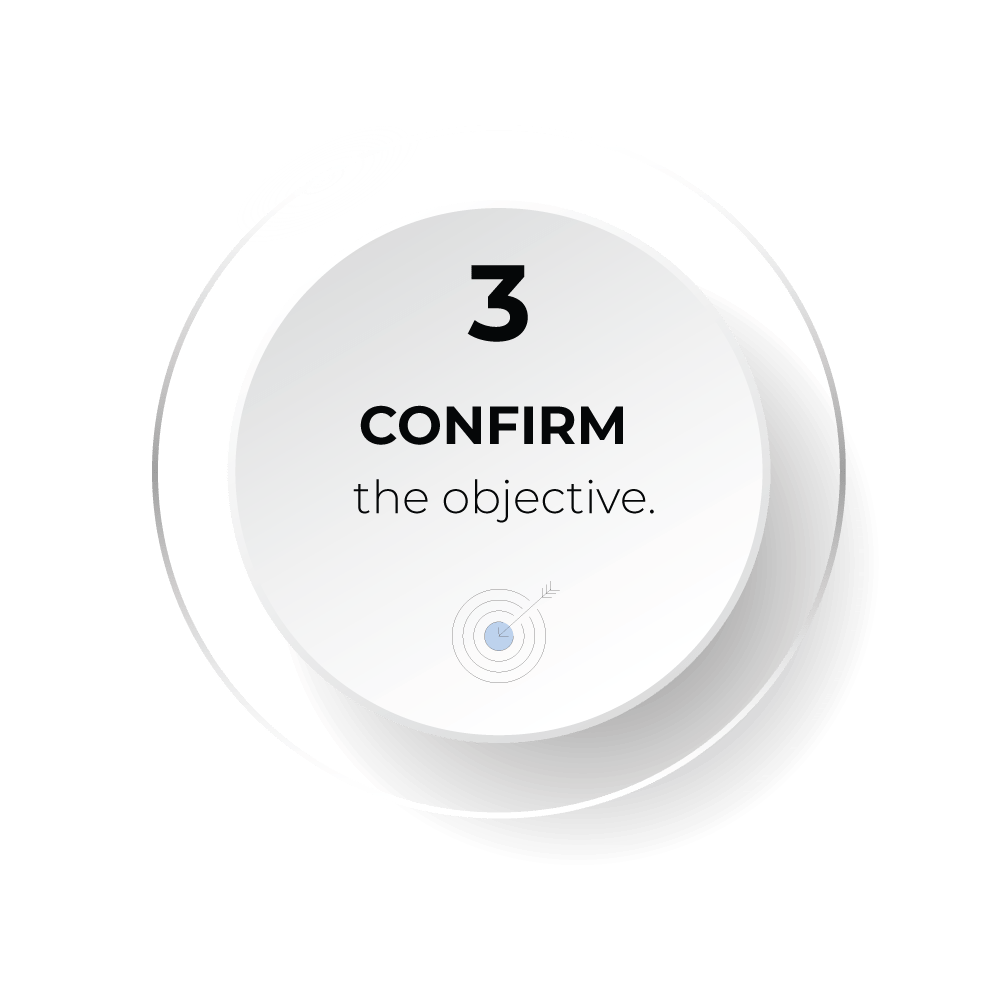

What do I Do if my partner has/ is trying to Sell/ Transfer Assets out of their name?

Question:

My wife and I separated six months ago. As I am a director of a company, the majority of our assets were put in my wife's sole name for asset protection reasons. Now that we are separating, my wife is trying to sell the family home and other assets to reduce the size of the property pool.

I know that I am entitled to my share of those assets but don't know how I stop her since the assets are solely in her name. What do I do?

Answer:

Situations like these unfortunately come up all the time. Not all couples will have all their assets held in joint names. This can done for a range of reasons such as tax reduction or asset protection.

Most people are not usually too concerned about having the asset in their spouse's sole name because they realise that even if the relationship does break down, the asset is included in the overall property pool anyway. However, for an asset to be included in the property pool, it generally needs to be owned by either you or your former spouse unless some argument could be raised as to a beneficial or equitable entitlement.

What we often see, is for one party to attempt to cheat their former partner out of a fair split by transferring or selling assets to a friend or family member to reduce the value of the property pool. Once the property settlement is finalized these assets usually return to the individual, giving them a far greater share of the 'true' property pool.

So, how can you prevent your former partner from selling or transferring assets that are solely in their name?

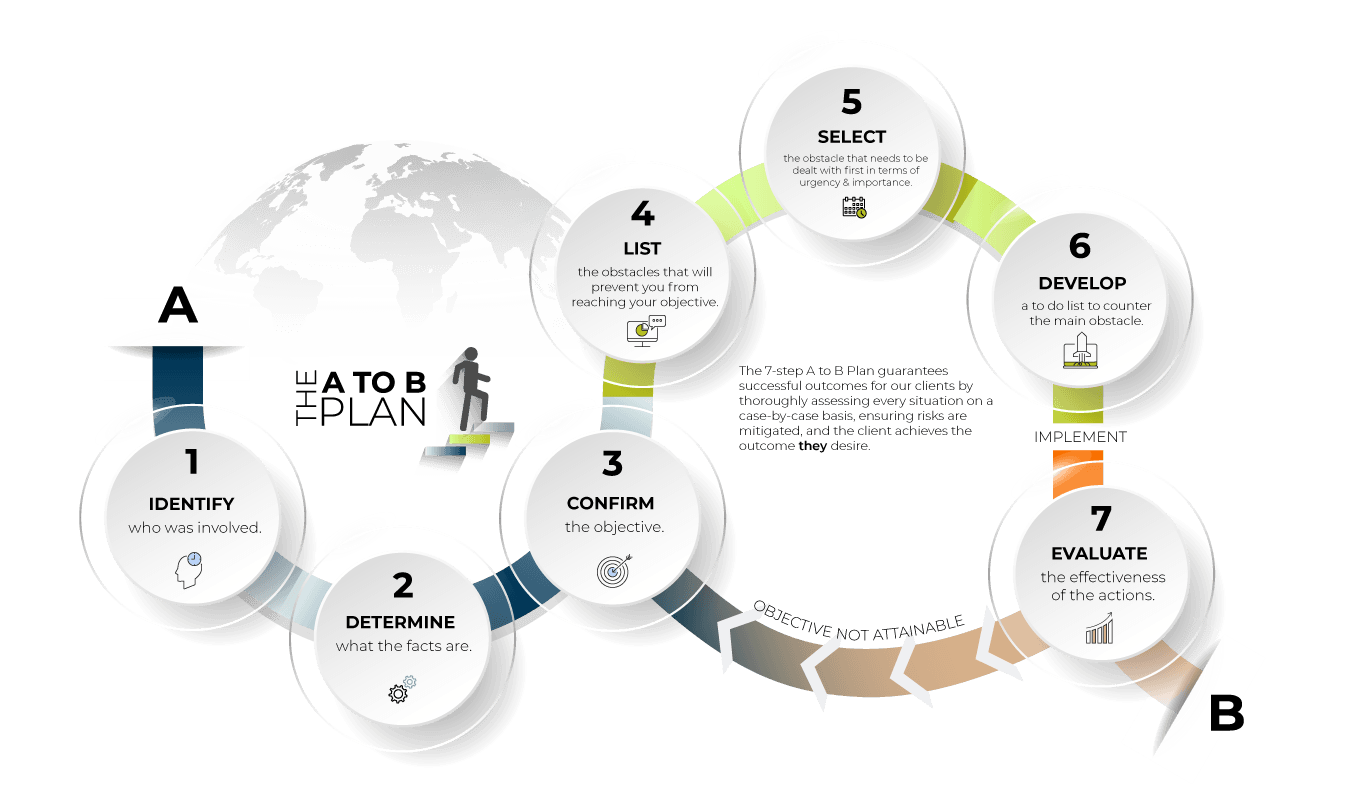

How to stop your partner from selling/ transferring assets that you have an interest in:

1. Identify who/ what is involved.

1. Identify who/what is involved.

When you are trying to stop the sale or transfer of an assets the first thing you need to do is identify the key people and things involved.

Is it a house? A company? A car? By figuring out the exact asset/s your former partner is trying to get rid of you will be able to identify the other relevant parties involved.

If your former partner is selling your family home or an investment property then you need to know who the real estate agent is. You also need to know who the conveyancing solicitors are.

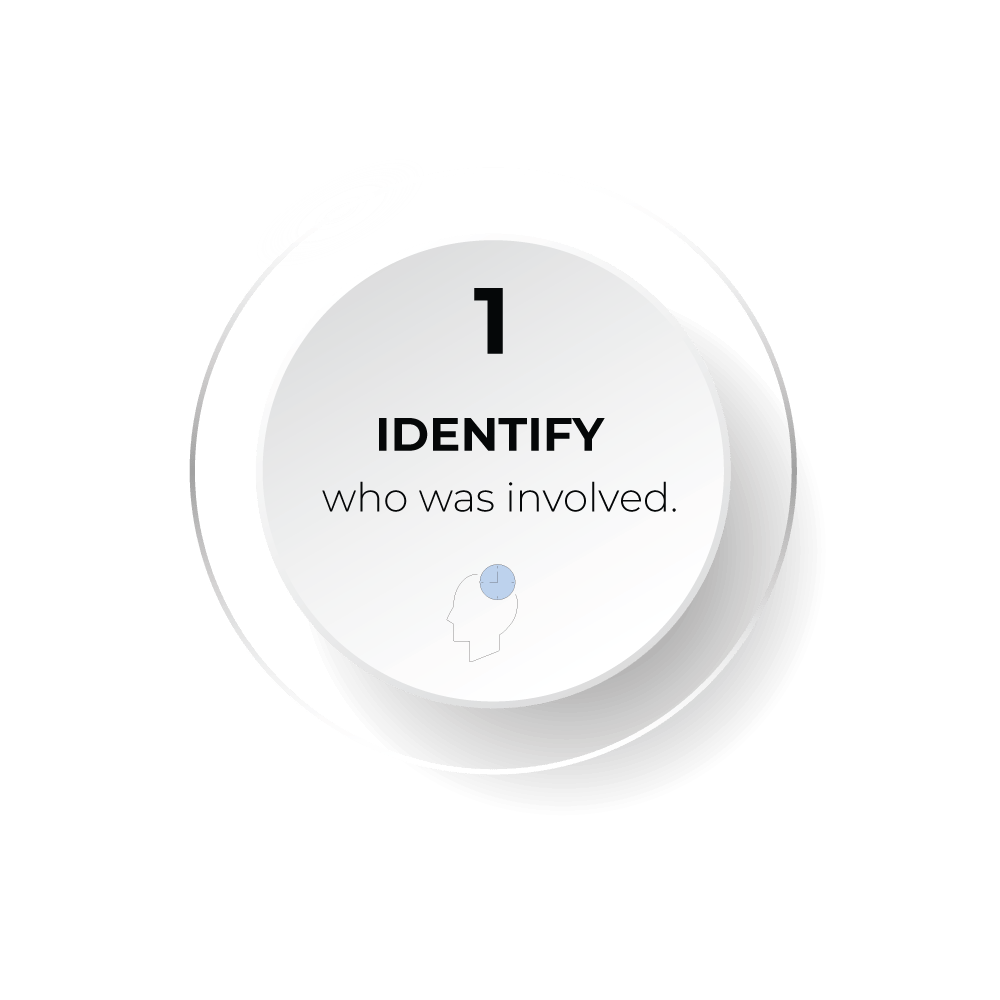

2. Determine the facts.

2. Determine the facts.

Once you know the asset/s your former partner is trying to dispose of, you need to note down the facts of the situation:

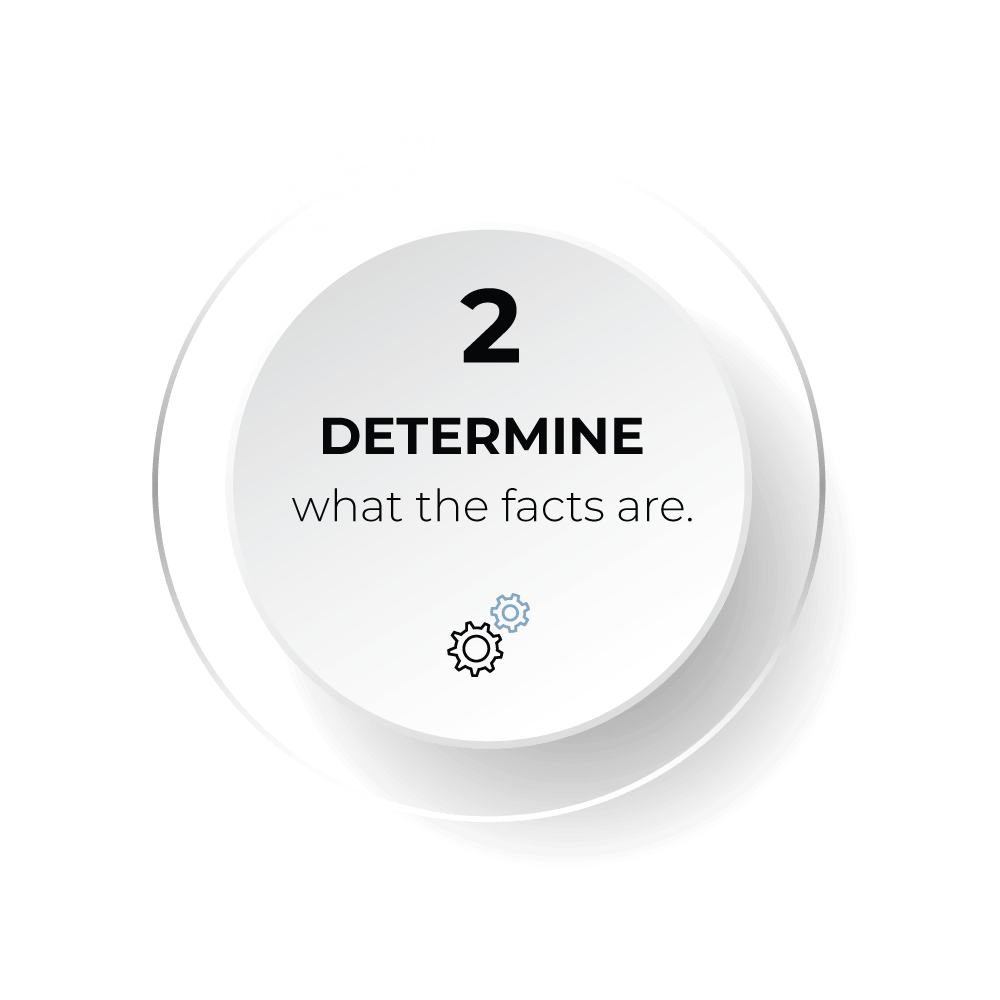

3. Confirm the objective.

3. Confirm the objective.

Step three is simply to confirm what you are trying to achieve.

You might not actually have an issue with the asset being sold but you want to be in control of its sale.

4. Identify the obstacles.

4. Identify the obstacles.

Now that you have your objective of gaining control of the sale (whether that be controlling the actual sale of the asset or controlling the sale to stop it from happening) it's important that you identify the obstacles that could stop you from gaining control.

The main obstacles we often seen in these situations are non-disclosure and time pressure.

4a. Non-disclosure

You may not be aware that the asset for sale even exists.

Example: Courtney & Harry

Courtney and Harry were in a de facto relationship for 5 years before they decided to separate. Being a de facto couple, they are entitled to a property settlement just the same as if they were married.

Courtney and Harry earned relatively the same amount of money but kept their finances separate. Harry knew that Courtney's family was "well off" and that Courtney received money/ assets from her parents regularly but didn't know any specifics.

As Courtney had never told (disclosed) Harry about these assets, Harry didn't even realise that these assets were being sold.

You also may not be aware of how far along the sale process is. For example, your partner may have listed a property for sale weeks ago without you knowing. By the time you discover that the property is for sale it could be too late. The deal could be done and there could be a contract in place.

4b. Time pressure

Timing also presents an issue. Even if you know the asset is being sold, assets like cars can sell within a few days. A house obviously takes some time but there are many assets that can be sold quite quickly. This presents a risk as you may not have enough time to prevent its sale.

5. Select the obstacle that needs to be dealt with first.

5. Select the obstacle that needs to be

dealt with first.

5. Select the obstacle that needs to be dealt with first.

Instead of trying to overcome all of the obstacles at once, it's important that you just focus on resolving one at a time.

Let's say you're in a situation where your former partner is trying to sell a property. You are obviously aware of the sale so timing is the issue not non-disclosure. As mentioned before, timing isn't as urgent on an asset such as real property, but still an important obstacle to overcome straight away.

On the other hand, if you aren't even aware of your former partner's finances and suspect they are hiding assets then non-disclosure is the obstacle you would tackle first. That's because you need to know what assets your partner is trying to get rid of first, before you can even take action to stop/ take control of the sale.

If you believe your former partner may be hiding assets from you read How do I find out what my former partner owns?. It goes over some of the most common places to check for hidden assets.

6. Develop a to-do list.

6. Develop a to-do list.

So what happens next?

You are now aware that your former partner is trying to sell one or multiple assets. You know that the biggest obstacle in gaining control of the sale is timing. Now it's time to develop a to-do list and execute the actions.

Example 1: Your former partner is trying to sell your house.

If you are in a situation where your former partner is attempting to sell your family home or an investment property without you, there are 5 things you will need to do to stop/gain control over the sale:

- 1Decide whether you want the house sold or not.

- 2Depending on what you want to happen, write to your former partner stating you are aware that they are trying to sell the property and that they need to either involve you in the sale or stop the sale immediately (depending on your objective).

- 3Next, urgently write to the real estate agent advising them of your interest in the property and request that any proceeds are held in a trust account.

- 4Finally, once you know who the conveyancing solicitors are, send that same letter to them asking that all the proceeds are held in trust.

- 5If necessary, you may need to commence Court action.

Example 2: Your former partner is trying to wind up their company.

If you found out your former partner was trying to wind up a company or trying to transfer all the assets out of the company into another company, the biggest obstacle will likely be the disclosure of everything.

If you're not a director of the company or if you have no actual involvement in the day-to-day running of the company, you may not be entitled to certain documents and information. The accountant may not be willing to talk to you or provide you with any relevant documents.

So in this situation where there is no cooperation from your former partner, the first step, may be to make an urgent application to the Court to seek injunctions prohibiting the transfer or sale of assets or the winding up of a company.

7. Evaluate.

7. Evaluate.

Finally, you need to evaluate how your actions have gone. Have your actions achieved the desired outcome?

You may give your former partner seven days to respond/ take action. If you don't receive a response in seven days, that's when you might consider further Court action.

TAKE AWAY: The most important thing to do when your former partner is trying to dispose of assets is to firstly identify the assets and then get a plan of action to take control of the sale.

Want a free tailored, step-by-step plan to take control of a sale/transfer?

Created by a qualified lawyer with no obligations.

If you have any questions regarding the sale or transfer of assets feel free to call us on 1300 767 384. Alternatively, book in for a free phone appointment above for your own free, step-by-step plan to gain control of at risk assets. It's created by a qualified lawyer and it's fully tailored to your situation.