10 Minute Separation Split.

Part 1: Identifying Assets & Debts

Don't have the time to do it yourself?

Let us work out what you may be entitled to instead.

Part 1: Identifying Assets & Debts.

We can all agree that going through a separation can be stressful.

You are probably feeling unsure of what your future may hold. Uncertain about what you will be left with. Maybe even concerned about what your quality of life will be going forward.

In situations like these, what most of us want is to simply get a better idea of what we may be entitled to.

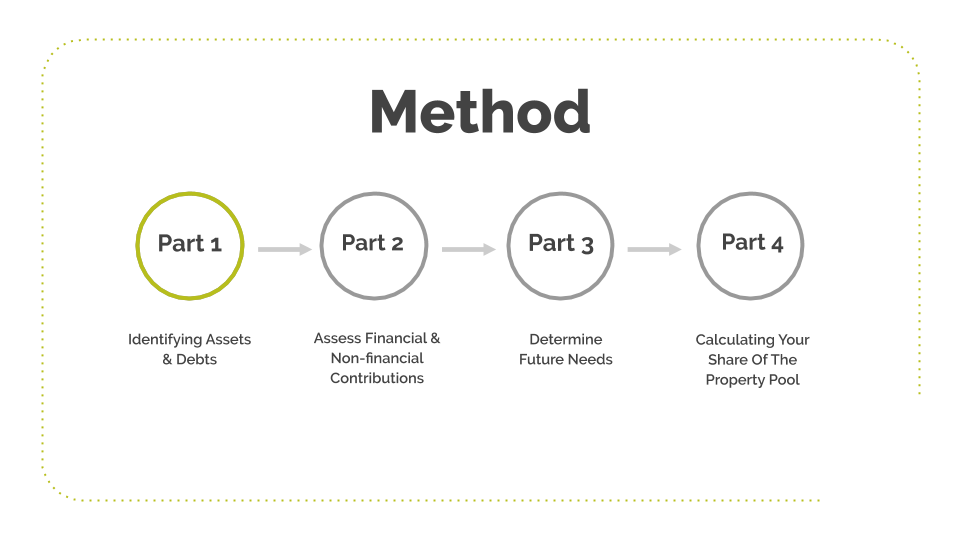

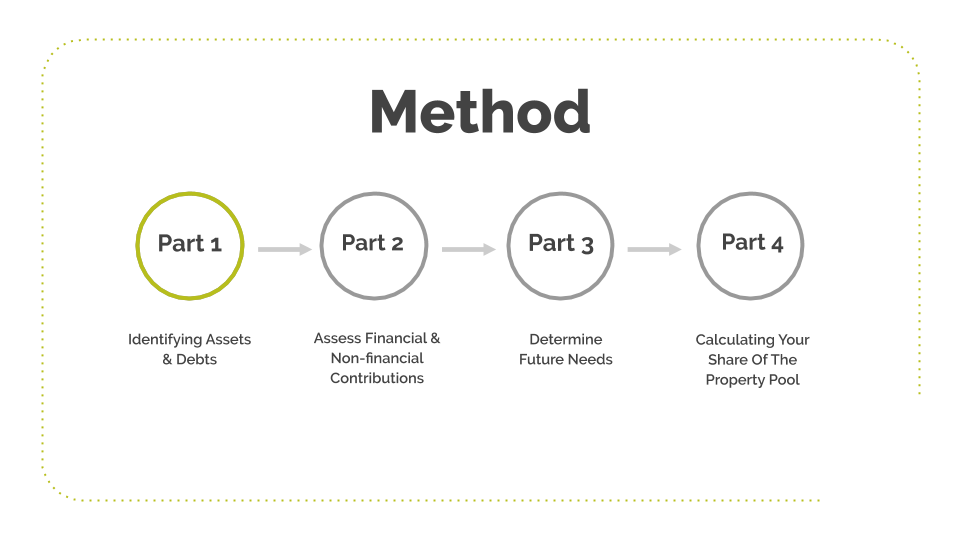

Well, in this video, I'm going to take you through part one of a four part method, that works out what assets and property you may be entitled to.

Replacing those feelings of confusion and uncertainty with feelings of relief and clarity.

This how-to video is broken into four parts, as calculating your share of the assets is no simple task.

We don't want you getting to the end of one big video feeling overwhelmed, thinking:

What am I meant to do next?

So, for this video, we're just going to take you through part one - Identifying yours and your spouse's assets and debts.

NOTE: It's really important to note that when we look at the assets and the debts, to determine how to divide them, we're looking at them as at today's date. That is the day that either you settle by agreement, or the day that a court determines your matter.

It is not the date of separation.

So that means, even if you separate now and you don't resolve your matter for another two years, you take the assets as at the date of resolution, not separation. So all of your assets and debts continue to accumulate together.

By doing this from the get-go, you won't have to spend time doing it with a lawyer.

We give you this option to do it yourself, because we understand that getting a property settlement is not cheap, so we want to save you money where we can.

So let's get started, by jumping into the questions we ask all of our clients when working out their share of the net assets, otherwise known as the property pool.

Stage 1 - Quantifiable Assets & Debts

Before we go through how to identify your quantifiable assets and debts, I recommend you download the Part One Identifying Assets and Debts Worksheet, so we can work through the steps together.

You can download this here:

Step One.

List all of the assets either you or your former spouse may have at today's date.

An asset is property which each spouse may be entitled to, whether in possession or whether they have a right to possess or own it.

NOTE: It's important to note that the definition of assets for family law purposes is very different to the ordinary asset description or Australian Accounting Standards description of what an asset is.

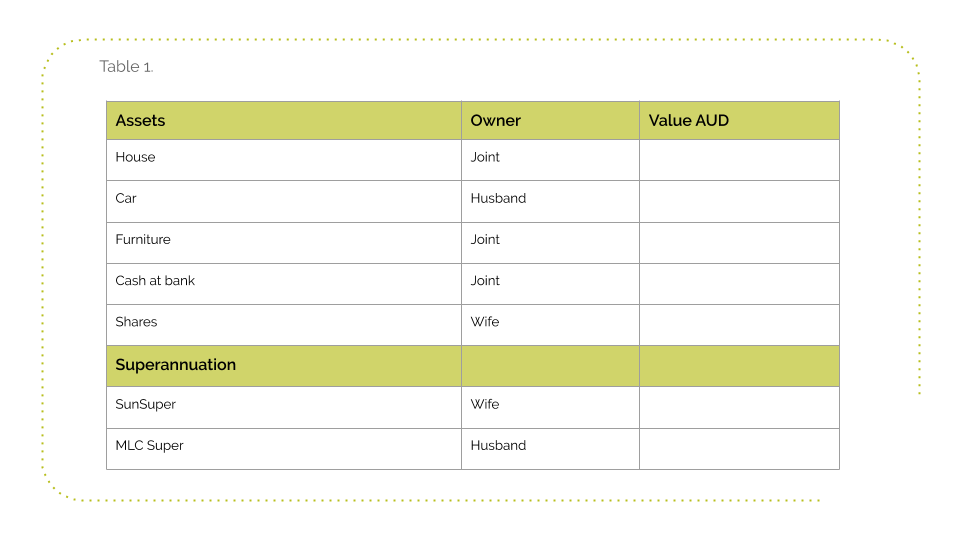

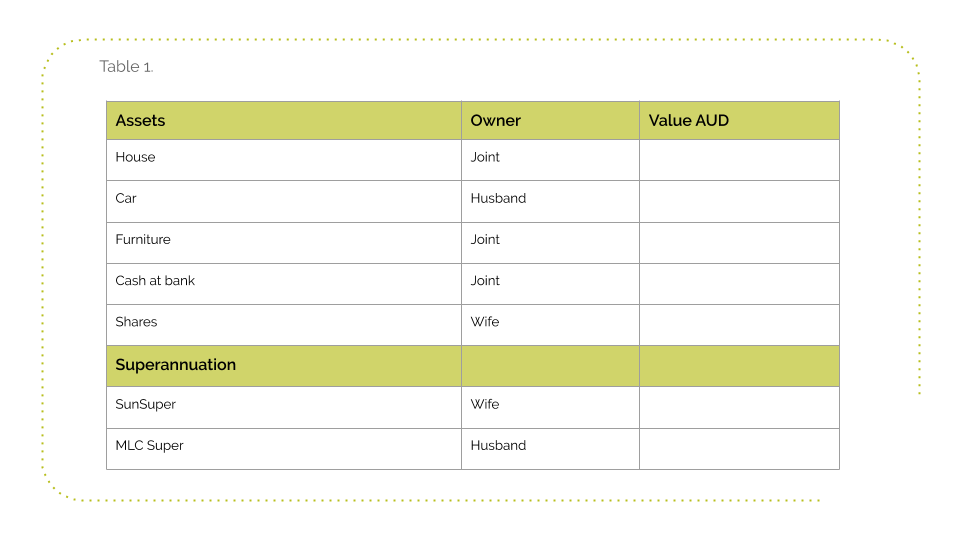

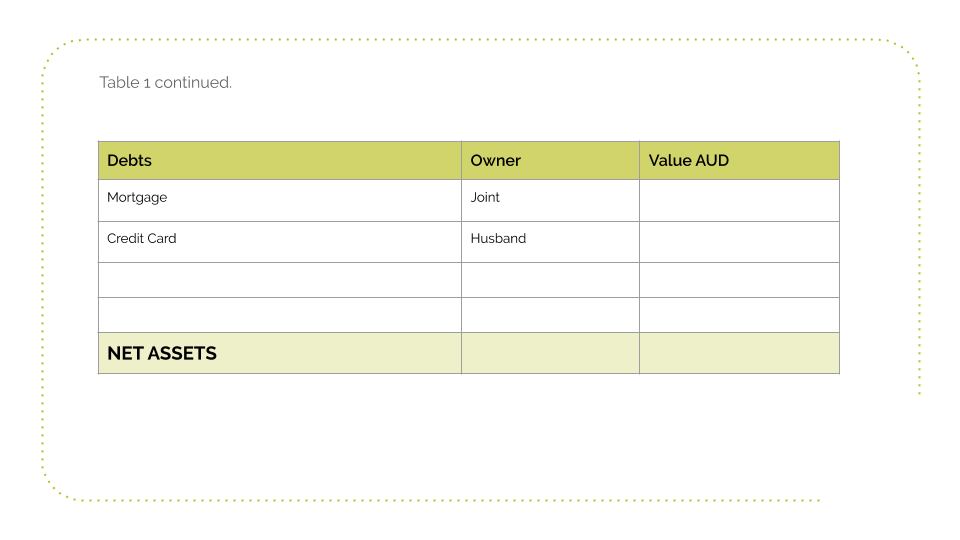

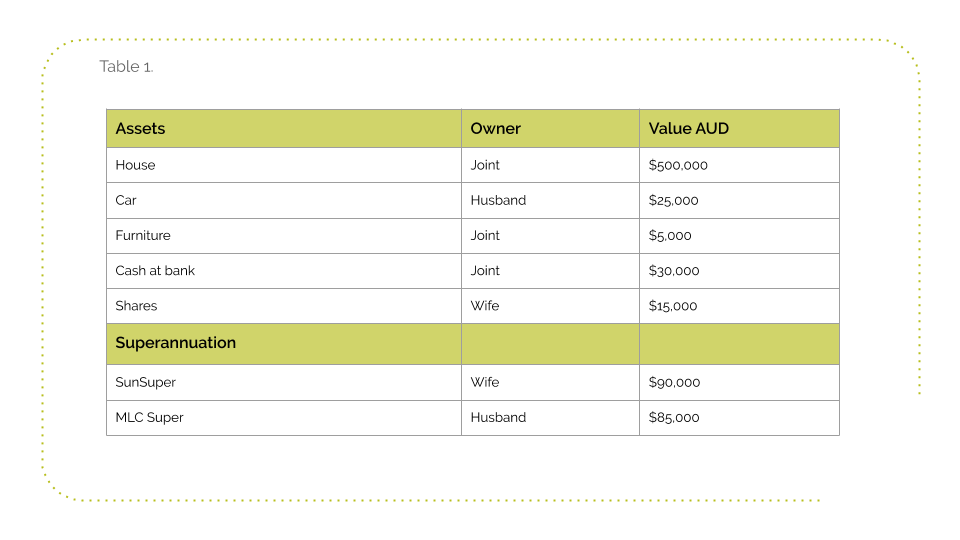

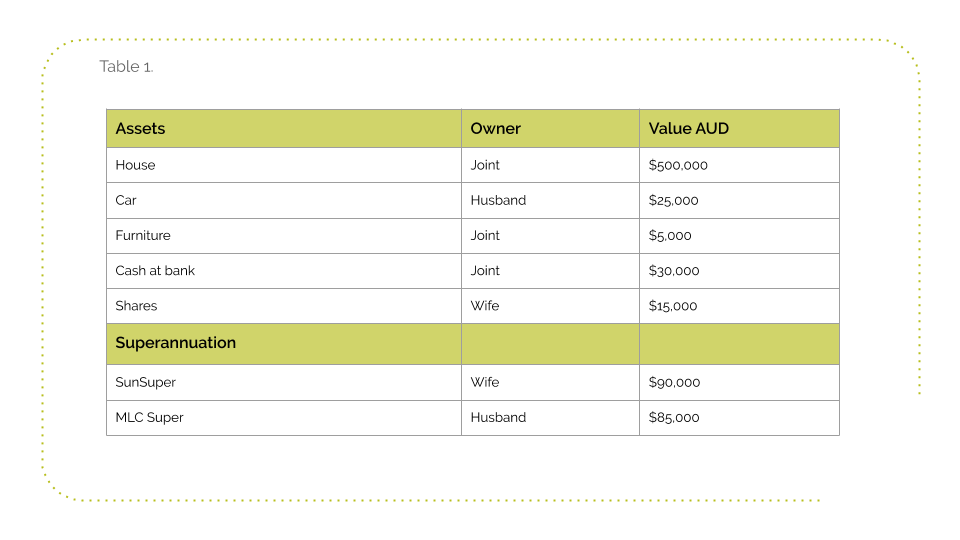

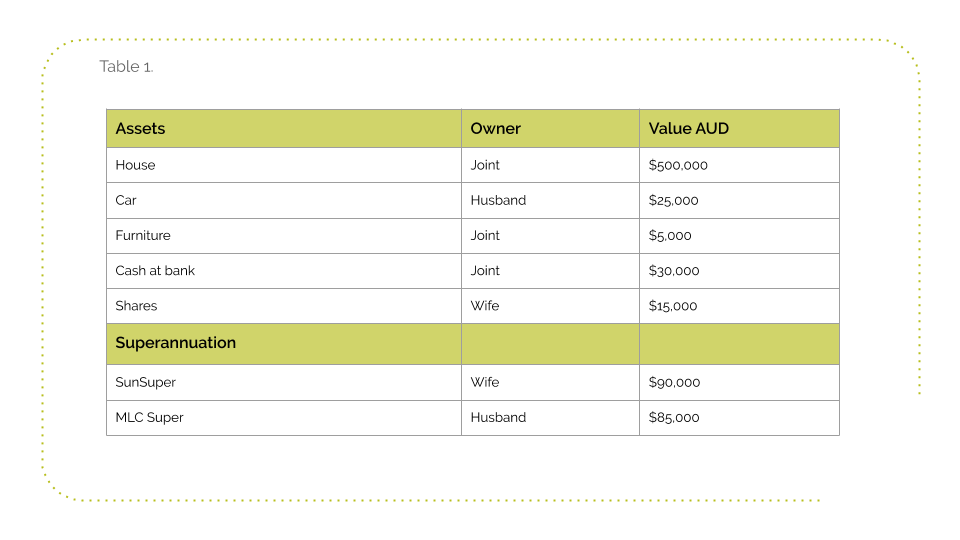

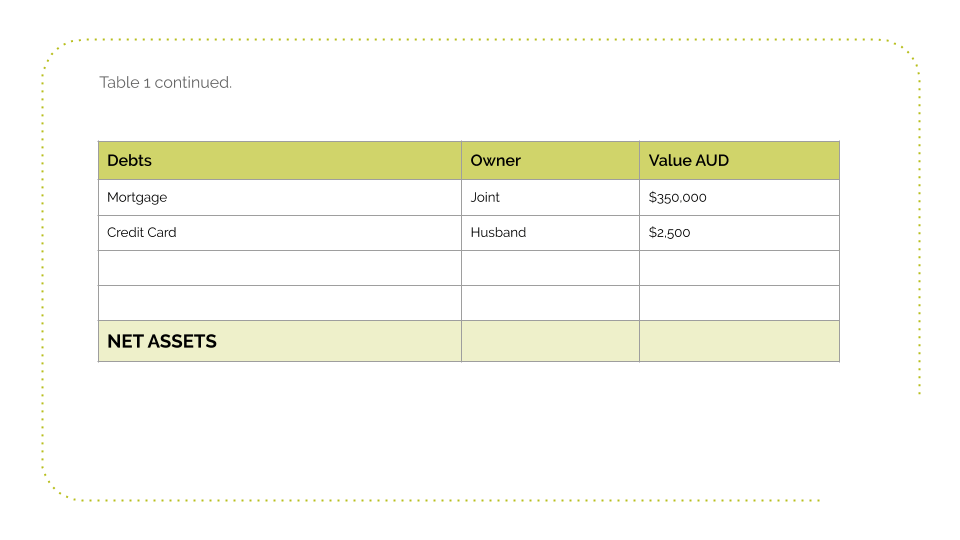

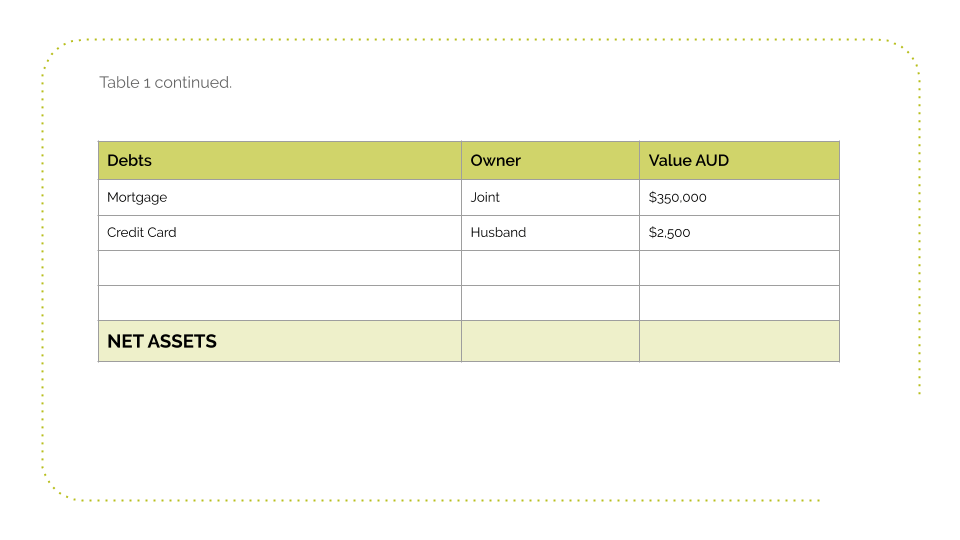

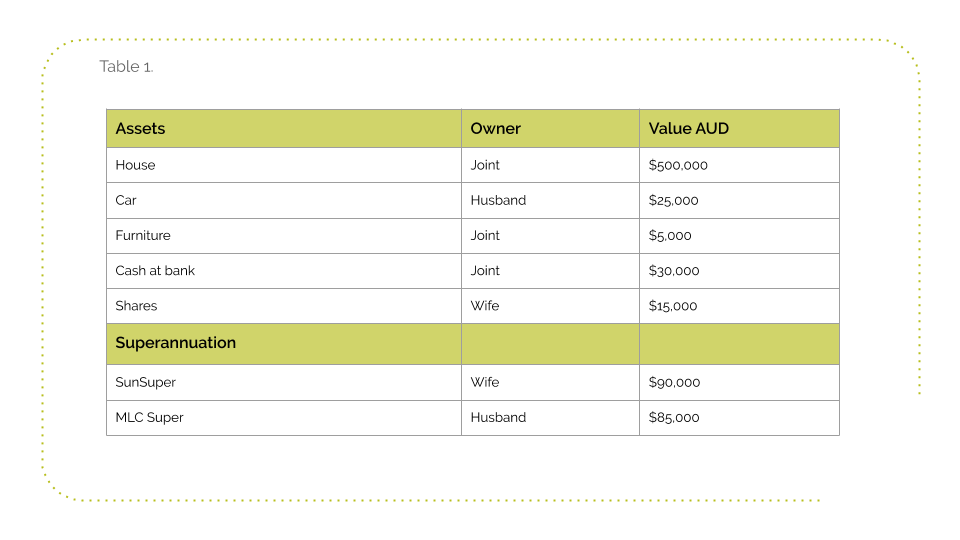

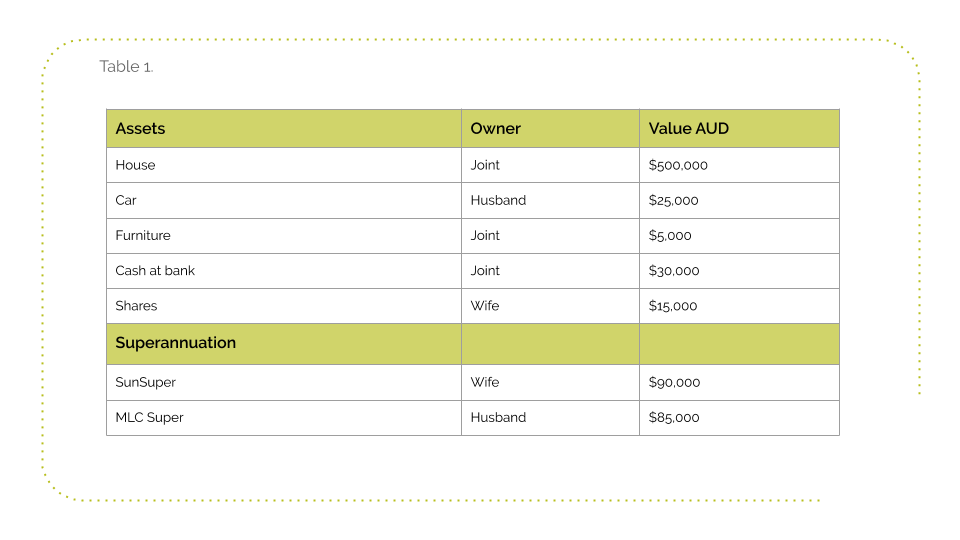

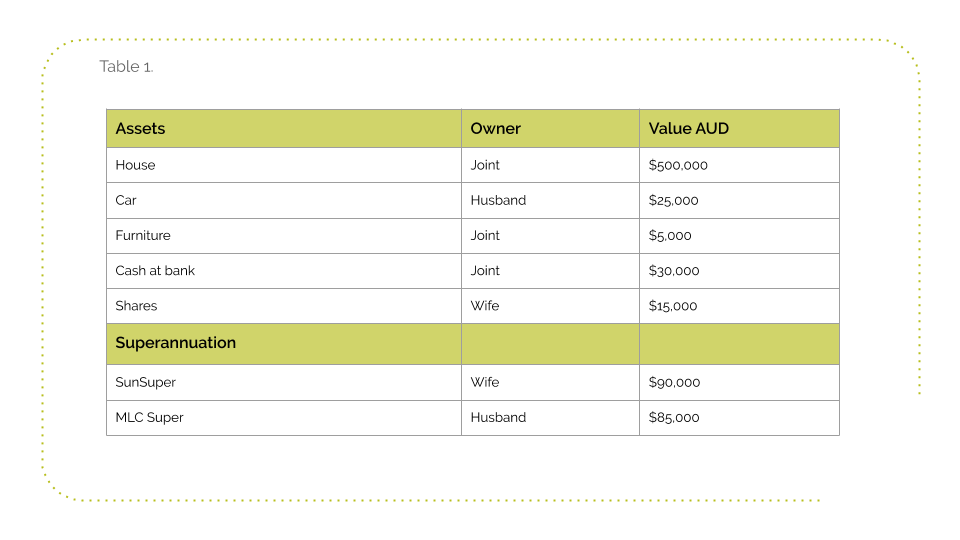

So go to section 1 of your worksheet. Here you will find table 1 that looks like the image below.

Here you will need to list any assets you or your former spouse may have and who owns each asset. For example list any properties, shares, cash in the bank and any superannuation either of you may have.

Step Two.

List all of the debts either you or your former spouse may have at today's date.

A debt is money owing (obviously), but it's a debt that must be likely to be enforced. So you saying that your mum lent you $10,000 twenty years ago, in circumstances where you:

is unlikely to be included in the property pool. It must be a debt that is likely to be recovered.

Examples of a debt are things like a mortgage, a credit card, a debt to the ATO. Anything that as I say, is likely to be enforced and called in.

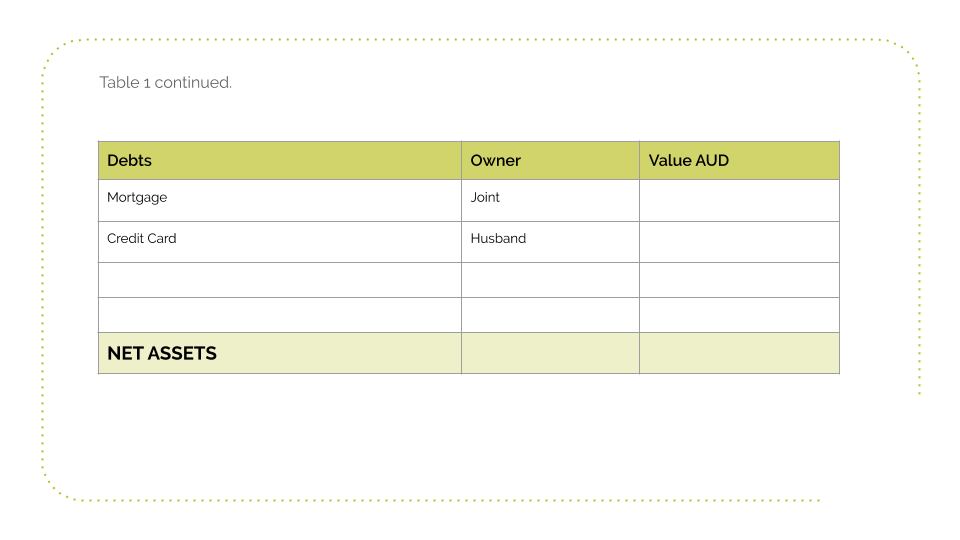

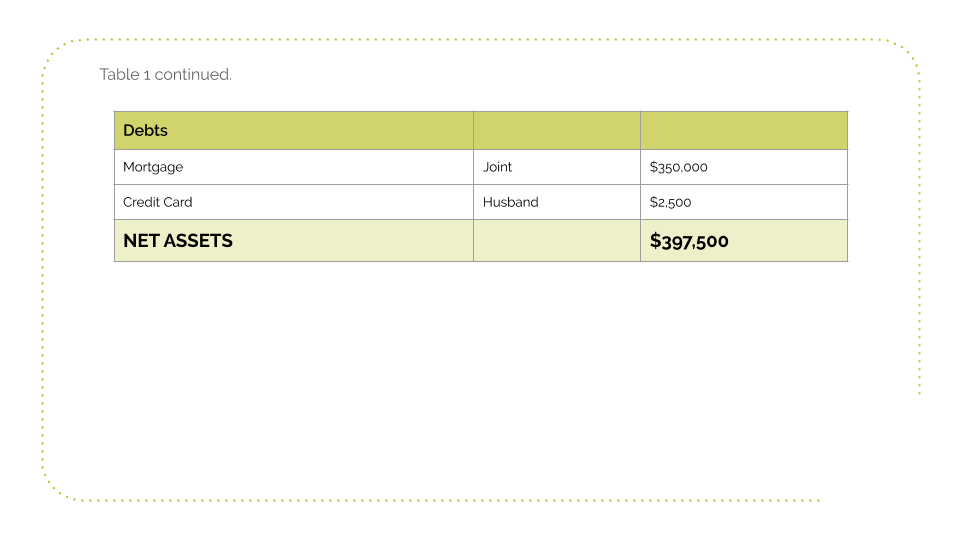

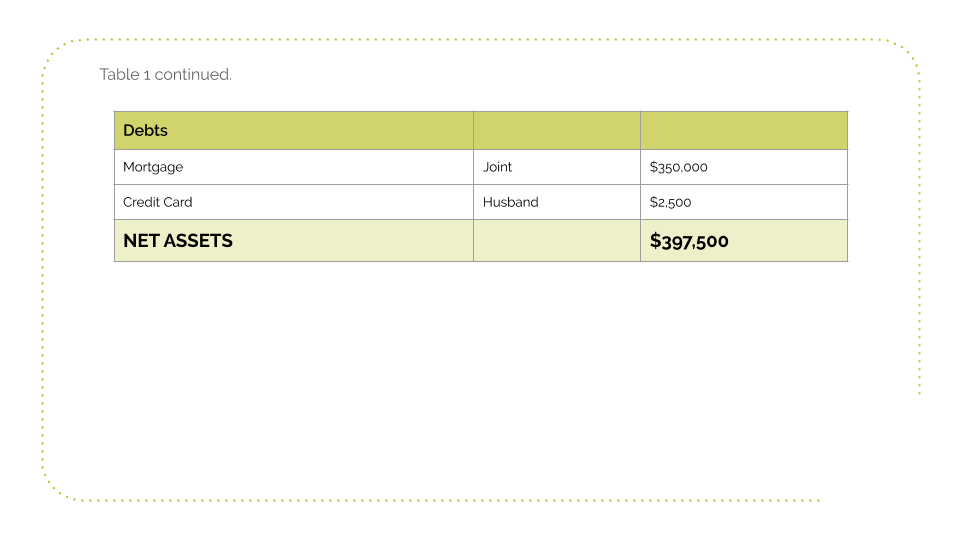

So go to the second half of table 1 and fill out any debts and the ownership of each debt, and then we can move onto the next step.

Step Three.

List the estimated value of each asset and debt.

So if you have a look at column number three in table one, you'll see the value column. Now let's try and attribute a value to each asset and debt.

It might just be your best estimate at this stage. We'll talk about formal valuations further on in this article and what to do when you and your spouse don't agree on what the value is. However, for the mean time we're just going to have our best bet.

As you can see in my example, the house might be worth $500,000, the car may be worth $25,000.

You can have a look online at Red Book or get a real estate appraisal, just to get an idea of an estimated value for the purpose of this stage.

After that we're going to do the same with debts.

Debts are often a lot easier to quantify, because they can be based off things like mortgage statements, or credit card statements, so you know exactly what might be owing to a bank.

So go ahead and fill in the value column of table one, and then we'll move on to the next step.

Step Four.

Total the value of the net assets.

To do this, we add up all of the assets and then we minus all of the debts to arrive at a net figure.

So you'll see here in the table, we've got all of the assets listed above and their values. We're going to add all of those up. We're going to include super, because remember, superannuation is an asset. And then we're going to minus all of the debts, and we're going to arrive at a net figure.

You'll see on the example that the net figure in this situation is $397,500. That is the net figure that we're ultimately going to divide.

So do that in your worksheet. Total all of the net assets and note it down in table one.

Then you have complete stage 1 - quantifiable assets and debts.

Don't have the time to do it yourself?

Let us work out what you may be entitled to instead.

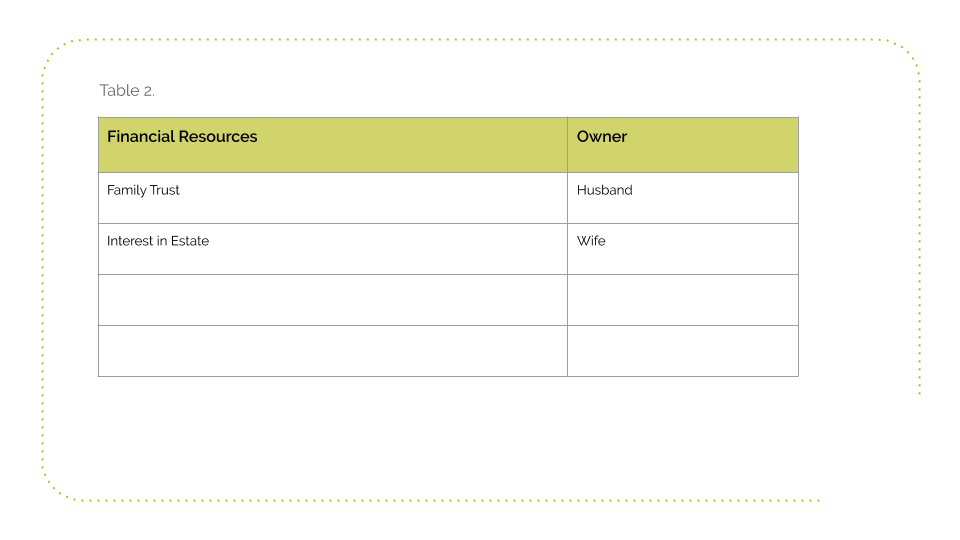

Stage 2 - Unquantifiable Financial Resources

Now let's take a look at unquantifiable financial resources.

So what is a financial resource & what makes it unquantifiable?

A financial resource is anything that can generate income or the reasonable expectation of receiving income. It's different to an asset in that it can't really be quantified.

Examples of a financial resource might be an interest in a family trust, or an interest in an estate. Something that, as I say, isn't exactly quantifiable. For example, if you are a beneficiary in a discretionary family trust, historically you may have received distributions every year. You don't know what amounts those distributions will be. You'll don't know whether you'll be getting any this year, so it's a financial resource as opposed to an asset.

On the other hand, if, for example, you were the trustee of that trust, and it was up to you to determine how to distribute the income, well, then it may be considered an asset. However, if you have no control over it, and you don't know what you're likely to receive, it's more likely to be a financial resource.

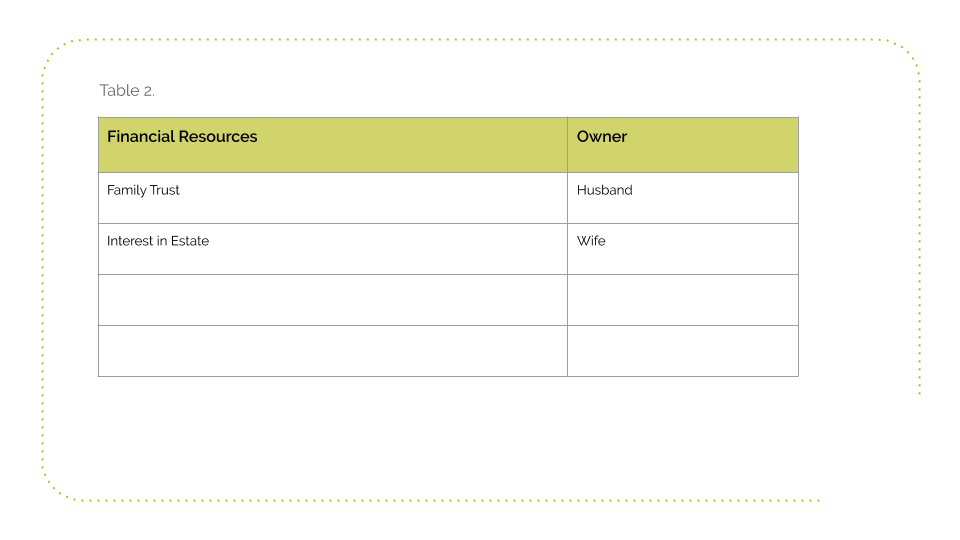

So go to table 2 in your worksheet and fill in the financial resources and ownership column. There is an example below on how to do this. After you've finished that we'll move on to stage three.

Stage 3 - Disclose All Of Your Financial Interests

You both have a duty to the court and to each other, to make full and continuing disclosure of your financial circumstances to the other spouse.

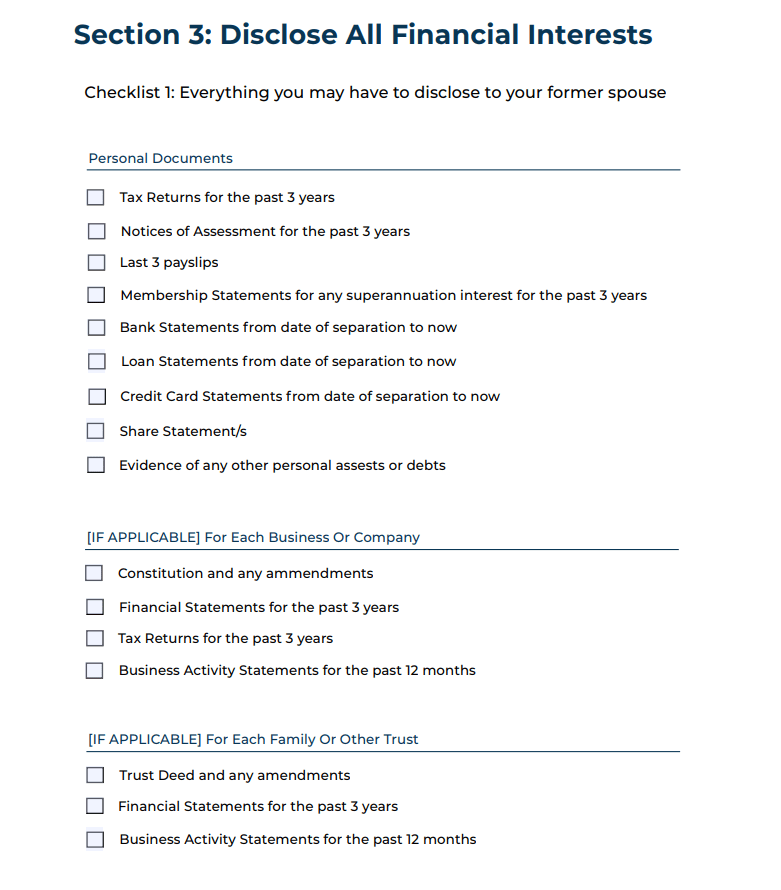

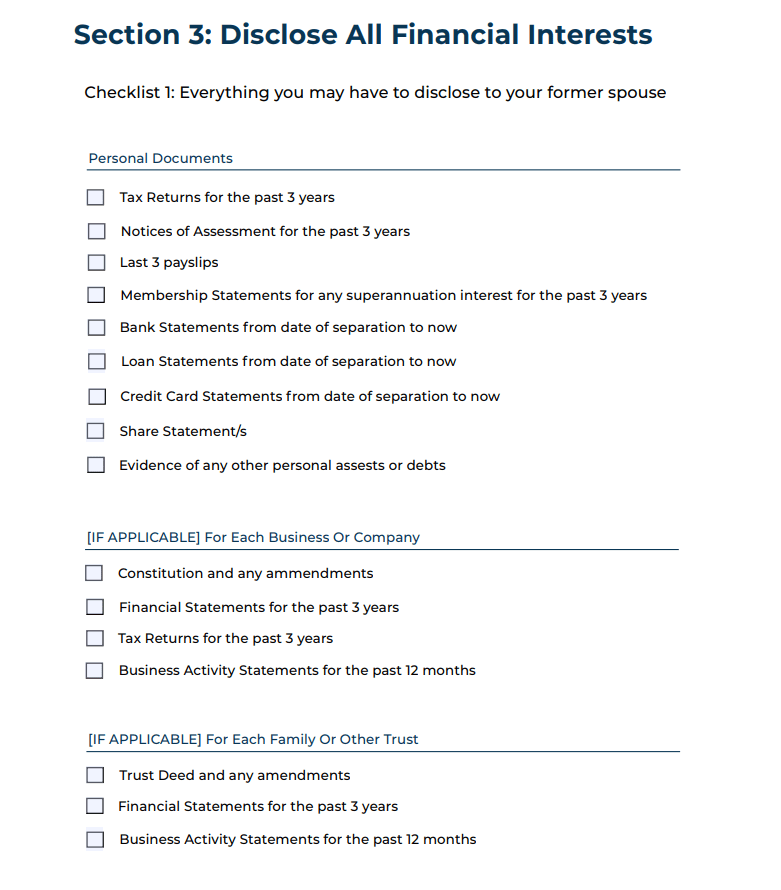

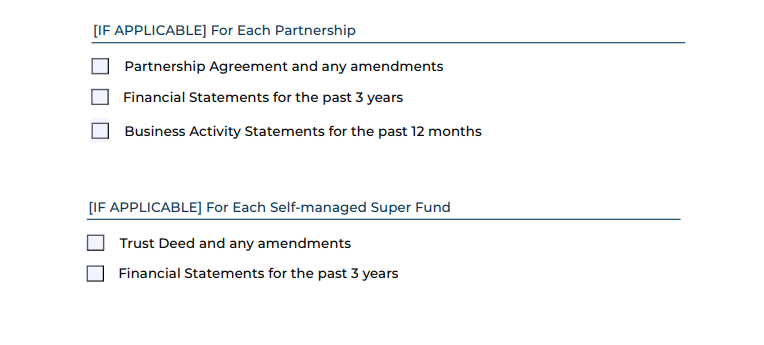

So what do you have to disclose?

Firstly, disclosure is just making it known to your former spouse.

Disclosure = making something known to your former spouse.

What you have to disclose can vary, depending on which court you're in, but documents that are generally required to be disclosed are things like:

Those are just to name a few.

But what if your former spouse won't disclose?

You can subpoena certain documents and information if you're in court.

A subpoena is a document that compels the production of certain documents or information.

Subpoena = a document that compels someone or a business to give you access to certain documents or information.

The benefit of issuing a subpoena is that generally you don't subpoena your former spouse. Instead you sort of go above their head, and subpoena the person that will actually have access to the documents.

For example, if your former spouse won't provide their bank statements, you'll instead subpoena the bank and the bank will provide those statements, rather than relying on your spouse to.

If you refer to section three of the worksheet, we've got a full checklist of everything you might have to disclose, depending on which court you're in.

Stage 4 - Independent Valuations

What do you do if you and your spouse don't agree on the value of the property pool, or of a particular asset or debt?

Anything not agreed on must be valued.

To value real estate, a registered valuer should be jointly instructed by you and your former spouse. This means you should agree on a valuer and tell the valuer to do the valuation.

To value things like motor vehicles, a Red Book value will often suffice.

Often, superannuation member statements are not entirely accurate, so you might have to do a superannuation valuation. We have provided a link to the form that you'll need to do that below:

A business can also be valued. That, again, will take you agreeing on a valuer and jointly instructing that valuer to undertake the valuation.

Often identifying the property pool's the hardest part of property settlement, and valuations and disclosure can take some time. But this step is so, so important. You need to know what it is you're dividing, before you can think about how you're going to divide it.

The more you do at the start, the easier this process will be overall.

Remember, you can't really make any offers of settlement until you know what your offer represents. You can't say, "I want 55% of something," when you don't know what 55% actually equals.

And that's it for part one! Now, when you're ready, you can move on to part two.

If you have any trouble or any questions regarding this video or your separation, feel free to contact us on 1300 767 384 or you can email us at [email protected].

Don't have the time to do it yourself?

Let us work out what you may be entitled to instead.