What is the difference between child support and spousal maintenance?

Question:

This may seem like a silly question but what is the difference between child support and spousal maintenance? Don't they cover relatively the same things?

Answer:

This isn't a silly question at all. In fact, it's a fairly common question we get in family law. Many people seem to confuse child support and spousal maintenance with one another but they ARE different.

What is child support?

As the name suggest child support is support for a child or children of the relationship. It is not financial support for your former partner or spouse.

Who determines how much child support is given and by who?

How much is given and by who is normally determined by a child support agency. However, if you and your former partner can reach an agreement between yourselves you can enter into a limited child support agreement or a binding child support agreement. Each of these agreements have very different rules but in both of these private agreement you and your former partner can agree to a range of different things. For example:

If you don't want a private agreement or you can't reach an agreement on child support, you can leave it up to the agency and the agency will undertake an assessment.

What does the child support agency look at in their child support assessment?

The child support agency's assessment is based off a few things but the main areas of interest are:

What happens in cases where a partner hasn't been involved in the child's life?

The fact that you're not involved in a child's life doesn't mean that you're not liable for child support. For example, if a child is born and the father says "I want nothing to do with the child" that doesn't preclude the mother from making an application to the child support agency for financial support for that child.

Is there any way to NOT pay child support?

The only way you cannot pay child support is if you enter into a private agreement where both you and your former partner agree that child support shouldn't be paid and that is stated in the private agreement. Unless you have that, the child support agency can still make an assessment and make one party liable to pay child support.

How long does child support last?

Child support is usually in place until the child is 18 or until a number of other things happen depending on what you have agreed upon in your private agreement.

What is spousal maintenance?

Spousal maintenance, on the other hand, is financial support paid by one person to their former spouse or de facto partner.

Do you have to have children to be eligible for spousal maintenance?

No. To be eligible for spousal maintenance you just need to pass the following two step test:

- 1Demonstrate to the court that you have a NEED for spousal maintenance.

Now, arguably it's relatively easy to say, "Well, I don't have an income because I have care of a child and my expenses are X amount each week, so I clearly have a need for X dollars". Which is why there is step two of the test:

- 2Prove that your former partner has the CAPACITY to meet that need.

Which is probably the hardest part as the payer (your former partner) must reasonable be able to pay the spousal maintenance. If they cannot afford to meet your needs then spousal maintenance will not be awarded.

So if you meet those requirements you will be eligible for spousal maintenance whether you have a child or not. However, having full time care of a child can usually be the reason as to why you have a need for spousal maintenance.

Who determines how much spousal maintenance is paid and by who?

You and your former partner can determine how much spousal maintenance is paid and by who between the two of you. All you need to do is reach an agreement and formalise it.

If you and your former can't reach an agreement about spousal maintenance the court will determine how much is paid and by who.

In these circumstances, the party seeking spousal maintenance will have to make an application to the court for spousal maintenance. Once the application is made the court will look at the pre-separation standard of living to determine whether the needs you are claiming are reasonable. The court will also assess whether or not the payer is reasonably able to pay the spousal maintenance. After doing so, they will make orders regarding the amount of maintenance to be paid, when it is to be paid and to whom.

Is there any way to NOT pay spousal maintenance?

As mentioned earlier if the applicant does not meet the requirements of the two step test you will not have to pay spousal maintenance. Unlike child support, spousal maintenance isn't an automatic entitlement.

Also, if you and your former partner agree that no spousal maintenance should be paid and this is state in a private binding financial agreement, then you won't be liable to pay spousal maintenance.

How long does spousal maintenance last?

Spousal maintenance usually has an end date. It may be paid for a specific period of time (e.g. one year). It may be paid until the property settlement is finalised or until that spouse retains themselves. It could even be until the children reach school age and they can return to a full time job. But usually there is an end date, however it is not unheard of that spousal maintenance is awarded on an indefinite basis.

The key differences:

If you have any questions regarding spousal maintenance or child support feel free to call us on 1300 767 384. Alternatively, book in for a free phone appointment below for your own free, step-by-step plan. It's created by a qualified lawyer and it's fully tailored to your situation.

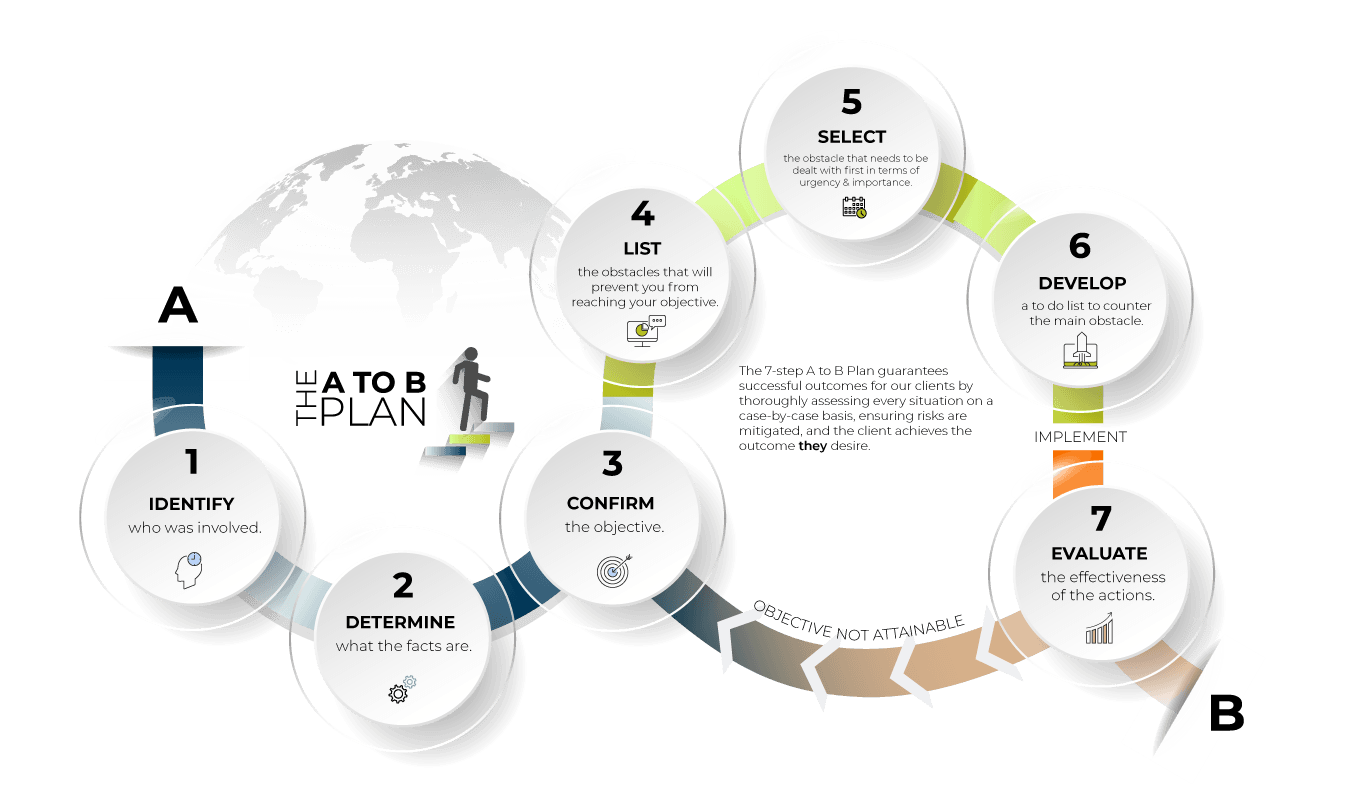

Want a free tailored, step-by-step plan to help you with your separation?

Created by a qualified lawyer with no obligations.